Our team consists of 17 Associate Agents, 2 coordinatos and our office broker. We speak a total of 14 languages in our office!

Our team consists of 17 Associate Agents, 2 coordinatos and our office broker. We speak a total of 14 languages in our office!

Plusvalía Tax

Plusvalía is a municipal tax paid to the local townhall and is based on the increase of the official value of the land between the purchase and sale dates.

The plusvalía or land value tax is the tax applied to the increase of the value of the urban land once a property is transferred, sold, inherited, or received after a donation.

This tax does not apply to the property itself, but to the value of the land it occupies.

When you bought the property you are planning to sell, the land in which it is located on had a value X. Now that you want to sell this value of the land may have increased (X + increase of value). And that increase is in part due to the improvements the town hall has made to the area and its surroundings.

There are more supermarkets nearby, better infrastructures, perhaps more public transport connections, etc.

So the plusvalía tax is the way the town hall has to capture that increase in value that is correlated to their public investments and improvements.

It is important to stress that Plusvalía only captures the increase in urban land value. Meaning that if the property is located in the countryside, this tax will be non existent or very little.

Also, it is important to mention that when the seller is a non-tax resident in Spain, the purchaser will be liable for this tax. Why? Because if the seller is in charge of paying it but fails to do so (because he is not in Spain) the Spanish tax authorities will go after the new owner. For this reason the buyer of the property will retain the money for the Plusvalía to pay on behalf of the seller, to guarantee the tax will be paid.

Non resident tax

According to Spanish Law (article 25.2 of Royal Decree 5/2004 that regulates Non-Resident Tax) if a non-resident sells a property in Spain, the buyer must withhold 3% of the purchase price and deposit it into the Public Treasury within one month in the name of the seller.

This payment is treated as an adva nced payment of capital gains ( see below).

If the non-resident taxpayer has made a loss or the tax liability is less than 3%, he/she will have to apply for a refund of the excess.

Capital Gains

Capital Gains

The capital gains tax is a tax paid by non-residents and residents that is applied when benefits are obtained from the sale of a property, that is, when the sale value exceeds the purchase value. In the case of residents, they will pay between 19% and 26% depending on the benefit obtained and some of the existing bonuses may be applied. For non-residents the rate will be 19% for non residents from EU/EEA countries or 24% for non residents from other countries.

The tax is based on the net profit made when selling a property, which is calculated by deducting the original purchase price (including VAT, Land Registry fees, property transfer tax and legal and notary fees) from the final sale price (less costs incurred during the sale).

There are a few exceptions and strategies that can be used to avoid paying Capital Gains Tax. For example, if you purchase another home as your sole, main residence using the proceeds from the sale of a property that you also used as your sole, main residence only then you are legally exempt from paying Capital Gains Tax. Also, if you are over 65 years old then you are not required to pay Capital Gains Tax, but you must have lived in the property as your sole, main residence for a minimum of three years prior to the sale of your property.

Lawyer Fees

We recommend that you use a lawyer to act on your behalf in the selling transaction. A lawyer will help calculate the costs and make sure everything is in your best interest

once there is a buyer. We work alongside many lawyers that we can recommend.

Looking for your new home abroad? Spain might be just the place. Whether you imagine yourself in a villa by the coast enjoying those long summers, or a trendy apartment in a vibrant city, we’ve got you covered!

Spain is a country of vast culture, fantastic cuisine and a high standard of living. Its cities have great architecture around every corner, and its countryside and sunny coasts are famous for their stunning scenery. Spain boasts first-class healthcare, education and no restrictions on foreigners buying property. As there are property types to suit every buyer, it won’t be hard to find the perfect place. Already tempted? Here are some of the most important steps in the process.

A good agent means the difference between a stress-free buying process – or the disaster of buying a property that just wasn’t meant for you. Fortunately, your RE/MAX agent will speak your language and take you step by step through the entire process. As a local expert, your agent can recommend properties the moment they come onto the market, and their information about the region is indispensable – they’ll advise you on the schools, transport links and neighborhoods, as well as cater to your specific needs.

Knowing the purchase process in advance will help you avoid stress, problems, and shocks in the future. Your agent will inform you about the various mortgage products that you can access in case you need financing, as well as the minimum savings you will need to carry out the purchase. There are many aspects to consider in this process, but do not worry because your REMAX Agent will guide you through every step!

To buy your new home, you will need an Identification Number in Spain.

If you are not going to be a resident in the country, you must apply for the so-called NIE of temporary non-resident, which is valid for 90 days. The request can be made in Spain, by going to your nearest police station, or through a power of attorney with a local law firm in case you are abroad. The NIE is essential to be able to sign the deed of sale and mortgage and it also needed in many banks in order to be able to request a study for a mortgage loan, so it is convenient that you do it as soon as possible if you are decided to buy a property in Spain considering two aspects:

A very important step before looking for the house of your dreams is to define a realistic purchase budget, considering the expenses of the purchase and in the case of assistance with financing, your maximum borrowing capacity and the savings necessary to undertake the investment. Again, your REMAX Agent will help you in the process.

If you are going to need financing, you should take into account some aspects:

However, the REMAX mortgage department is at your service to help you, without cost or commitment, to choose the best financing for your purchase and be alongside you throughout the financing process.

Once you have chosen the house of your dreams, you must make an offer to the owner and in case of being accepted, sign the deposit. The role of your REMAX Agent is this step is key to help you make informed decisions. He knows the market, the last sales made in the area and the actual closing price of other homes in the same neighborhood which it will give you valuable information so you can buy your house at the best price possible.

Your REMAX agent will defend your purchase proposal with the owner and/or his representative agent, praising your strengths as a buyer. He will also define a negotiation strategy with you in case the seller makes a counteroffer.

Once your offer has been accepted, you will express your intention of purchase in a document called ARRAS PENITENCIALES, which will be signed by both parties along with the delivery of a percentage of the purchase price on your part as a symbol of firm commitment.

In case of breach of contract on your part, you will lose the amount delivered, and if the other party is the one who breaches it, the seller must return the amount of the deposit doubled as compensation. It is very important that at the time of signing the ARRAS, you are clear that you have the necessary savings and the bank approval for a loan in firm, if you need it, so as not to incur in the loss of the money delivered.

The next step is to go to a Notary to formalize the deed of sale and the mortgage, if necessary.

Your REMAX Agent will be responsible for carrying out all the document and registration checks to ensure that your purchase is made with all the guarantees.

Deciding where to buy in Spain will come down to taking into consideration some factors such as: your budget, the lifestyle you are looking for, the weather, the gastronomic offer or public transportation. If you’re looking for a laid-back lifestyle in the sun, the coast could be your place.

Questioning whether you prefer city, the coast, or the countryside, is much more than the landscape you dream of waking up. Do you expect a friendly expat community where you can adapt easily, or do you prefer to integrate with the locals and fully immerse yourself in their lifestyle?

Each region of Spain has its own culture and traditions to explore, so don’t take the decision lightly. The reason you’re choosing to move, or buy a second home, could define the type of property you’re looking for.

Visiting the country several times allows you to get a better idea of the type of neighborhood and property you want to acquire.

Your RE/MAX Agent can show you the best homes in the places you like, maybe even areas you hadn’t thought of yet, that´s why he will spend a lot of time getting to know you, your family, and your needs. This is the best way to help you find your home, your new home!

If this all sounds good, you’re ready to take the first steps. We invite you to visit different areas of the country to define your purchase area, look at some properties online and familiarize yourself with the market, but the most important thing is that you have a professional on your side, so get in touch with a RE/MAX agent to get going and solve all doubts. You’ll see how easy it is!

One of the most frequently asked questions by homebuyers is what are the costs added to the purchase price. In order to explain them, we must separate between purchases of new builds and second-hand properties, as their taxation is different:

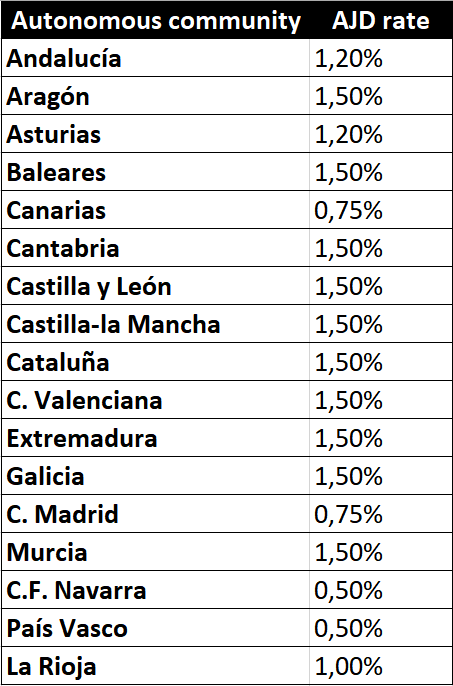

New builds:

In special cases, such as for disabled people, large families or people under 35 years of age, some autonomous communities apply reduced AJD rates. If you are looking for a property, at RE/MAX Beach Homes we will be happy to assist you with all the issues involved in buying a property, and of course to help you find the most suitable one for your needs.

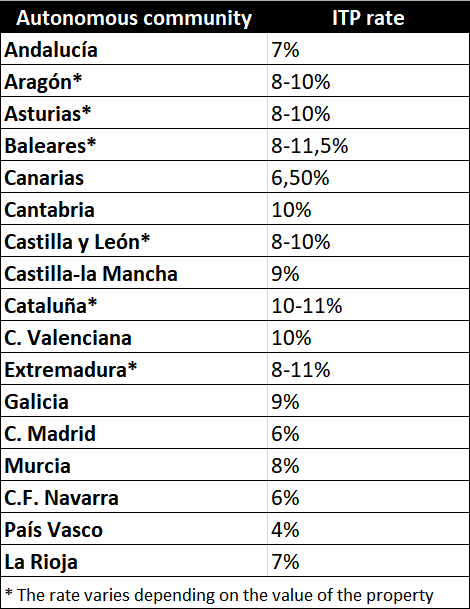

Property resales:

As with stamp duty tax, in special cases some autonomous communities apply reduced rates of the Property transfer tax. Also as in the previous case, the reference value of the land registry is used as the basis for its calculation.

Other expenses:

The sale and purchase of a property entails other expenses apart from taxes and which are borne by the buyer:

Playa Flamenca is a residential area located in the south of the province of Alicante, close to bigger towns such as Torrevieja or Alicante (in the north), or Pilar de la Horadada, San Pedro del Pinatar or Cartagena (in the south). It belongs to Orihuela Costa, which is a district of Orihuela, and borders with La Zenia to the south and with Villamartín urbanization to the west. Playa Flamenca is located near two international airports: Alicante-Elche Miguel Hernández, 45 minutes away, and Region of Murcia, 40 minutes away. It also has a very good road connection with the beaches and areas of tourist interest on the Costa Blanca.

It is surrounded by all kinds of services such as restaurants, bars and supermarkets. Just 1km away is the Zenia Boulevard Shopping Center, the largest shopping center in the province of Alicante, with an area of 160.000 m², 5.000 parking spaces, 150 stores where we can find the main brands in fashion for men, women and children, sports, footwear, perfumery, food, telephone, accessories, home, bricolage, jewellery, toy store, pet shop, etc.

In 2020, the residential had around 1.700 inhabitants, the majority being British, German, Belgian and Scandinavian.

BEACHES

Playa Flamenca has two beaches, La Mosca and La Estaca, both holders of the Blue Flag badge since 1992 and the Q for “Tourist Quality” awarded by the Ministry of Tourism since 2014:

COMMUNICATIONS

During the whole year, Playa Flamenca has two bus services from Costa Azul company that connect it with the rest of the Orihuela Costa urbanizations and with the Torrevieja bus station, from where many connections can be made with other cities in Spain. You can access all the information on the lines in the service app or in the following links:

ENVIRONMENT

Playa Flamenca is a privileged environment for its tranquility and has a wide range of bars, restaurants, supermarkets, schools and services. The Zenia Boulevard Shopping Center, the largest in the province of Alicante, is located a few minutes from Playa Flamenca. There are 150 shops there and it holds regular activities and concerts for the whole family. The Playa Flamenca area is located in one of the best and most important golf areas in the Mediterranean with five excellent golf courses of recognized international prestige: Campo De Golf Villamartín, Club De Golf Las Ramblas, Real Club De Golf Campoamor, Las Colinas Golf & Country Club and Vistabella Golf.

Playa Flamenca has around 6 km of bicycle lanes from Campoamor to Punta Prima, which allow anyone to enjoy the area while having a bicycle ride with the safety offered by this exclusive route for cyclists.

The area also has the following marinas:

Playa Flamenca has a wide range of restaurants ( The Lobster and Surfers Bar & Grill stand out), pubs with live shows and supermarkets from large chains such as Carrefour, Lidl or Mercadona. In addition, every Saturday from 9 a.m. to 2 p.m., a street market takes place on the street Pintor Ribera, where you can find all kinds of products at a good price.

In Spain, as we all know, the purchase of a property entails the payment of taxes after signing the corresponding deed, specifically: VAT and Stamp Duty for new-build homes, and Property Transfer Tax* for second-hand properties. The method used for the calculation of the latter has changed as from 1st January 2022, Law 11/2021 to prevent and fight against fraud came into force, which includes a modification of the base tax used to calculate the Inheritance Tax and the Property Transfer Tax. Until that date, the tax base they used was the real value of the sale declared in the deed, unless the tax authorities could demonstrate that the market value was higher.

In order to reduce the judicial processes derived from these cases, the new law has introduced a ‘reference value’ that will be used as the tax base for the calculation of the taxes mentioned above. This means that if, for example, before we had to pay 10% of the purchase price of the property for Property Transfer Tax in Comunidad Valenciana, now we will have to pay 10% of the ‘reference value’. This value will be determined by the General Management of the Cadastral Home Value based on the prices of the sales declared before a notary and taking into account the location and type of the property. However, it will not take into account the state or, for example, if a refurbishment is necessary (which implies a devaluation of the price), so it is possible that the ‘reference value’ is, in certain cases, much higher than the market price. In any case, buyers can claim, providing evidence, if they consider that this value is higher than the market value, although the General Management of Cadastral Home Value states that this value will not exceed the market value and that a reduction factor will be applied with this purpose.

*The taxation for Property Transfer Tax in the Valencian Community at the time of writing this text is 10%

Housing prices in Europe are rising at the fastest pace since 2006, S&P Global said, as the residential home market recovers from the pandemic faster than other sectors of the economy. The report also said that while inflation may have peaked.As supply of new housing is not able to keep pace with structural demand, S&P expects the rise in housing costs to continue over the next four years. One major reason for the rise is that people have accumulated savings during the pandemic due to lockdowns and restrictions on going out. With more savings put aside, households have been able to put down larger deposits.

Also, lower borrowing costs have contributed to rising house prices, as central banks loosen monetary policy as a response to the pandemic. Interest rates fell to a new record low of 1.32% for new housing loans in the eurozone in August.

While there is growing demand for property, there are also more acute supply constraints, after construction activity was put on hold at the onset of the pandemic. People are looking for different types of property since the pandemic, most wanting more outdoor space after been confined for so long in their homes.

If you are thinking of buying in the near future, maybe now is a good time as prices are still stable. Contact us and let us help you find your dream property, whether you are looking for a holiday home or permanent living.

Once again our area of the Valencian Community, Vega Baja del Segura, has been awarded with 26 blue flagged beaches, the leading area of Spain for 2021!

You can enjoy the fine sand and crystal waters from Pilar de la Horadada up to Guardamar del Segura. Orihuela Costa being the area with the most blue flags, 11 in total.

Vendemos tu casa