Property purchase expenses in Spain in 2024

One of the most frequently asked questions by homebuyers is what are the costs added to the purchase price. In order to explain them, we must separate between purchases of new builds and second-hand properties, as their taxation is different:

New builds:

- VAT (Value Added Tax): 10% of the purchase price. For example, for a property with a price of 200.000 €, the VAT would be 20.000 €.

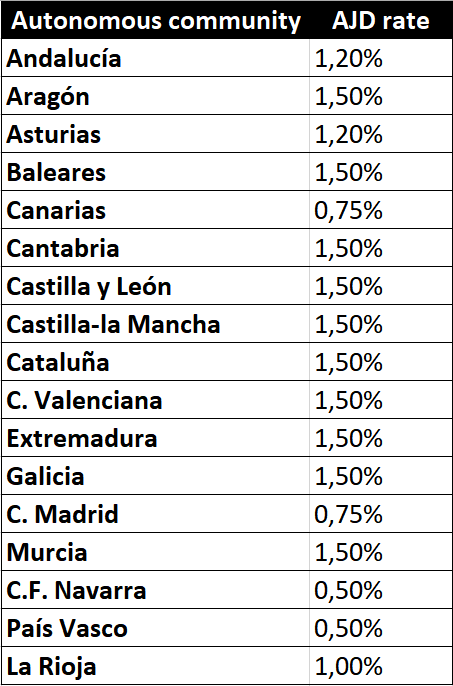

- AJD (Stamp duty tax): This is a tax levied by the autonomous community in which the property is located and its taxation depends on it. The following table shows the different rates at the time of writing this article:

In special cases, such as for disabled people, large families or people under 35 years of age, some autonomous communities apply reduced AJD rates. If you are looking for a property, at RE/MAX Beach Homes we will be happy to assist you with all the issues involved in buying a property, and of course to help you find the most suitable one for your needs.

Property resales:

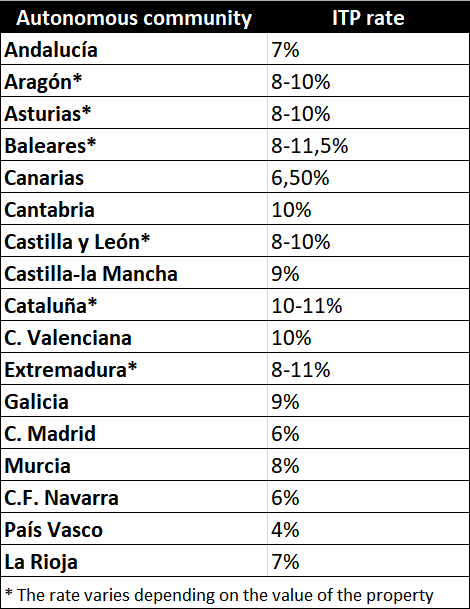

- ITP (Property transfer tax): Like stamp duty tax, it depends on the autonomous community in which the property is located. Until 31 December 2023, the purchase value was used as tax base to calculate the ITP, but this situation changed from 2022 with the introduction of the new “Reference Value” by the Dirección General del Catastro (General Directorate of Cadastre). From this year it is the tax base for the calculation of other taxes in addition to the ITP such as Inheritance Tax, Wealth Tax, Income Tax or Municipal Capital Gains Tax. You can check the cadastral value of a property on the Cadastre website (you must identify yourself digitally). At the time of publication of this text it is as follow

As with stamp duty tax, in special cases some autonomous communities apply reduced rates of the Property transfer tax. Also as in the previous case, the reference value of the land registry is used as the basis for its calculation.

Other expenses:

The sale and purchase of a property entails other expenses apart from taxes and which are borne by the buyer:

- Notary fees: Although in Spain it is legal to carry out a sale and purchase with a private contract, it is highly advisable to opt for the purchase before a notary to avoid problems. Notary fees depend basically on the amount of the transaction, the number of pages of the deed and the number of copies of the same, so it is not possible to know in advance the exact notary fees, but it is usually a value between 0,5 and 1% of the price of the property.

- Land registry: The land registry is a public institution with the function of certifying the legal conditions of a property. It is the best guarantee that an owner can have to prove the ownership of a property to third parties. The registry fee is based on the value of the property and is governed by tables. It is usually between €150 and €400.

- Agency commission: Some agencies charge a commission to the buyer and, although it may be a fixed price, it is usually a percentage of the purchase price, normally 3%. This commission is hidden from the buyer, it is not reflected in the advertised sale price, so we advise you to always ask the agency if they charge this commission. At RE/MAX Beach Homes we do not pass on any commission to the buyer and the price we advertise is the final price, with no hidden agency commissions.

- Lawyer/Administration: It is highly recommended to hire a lawyer to audit and manage the purchase of a property. Although the land registry informs about the legal situation in terms of mortgages, charges, usufructs, etc., there are circumstances that sometimes owners do not communicate nor they legally register, such as extensions of the built area that must be legalised to avoid problems in the future. On the other hand, non-resident buyers in Spain, need to obtain a NIE, pay taxes and register the property in the land registry so the hiring of a lawyer is doubly recommended in these cases.